What Is a USDA Guarantee Fee and How Does It Work?

Learn what a USDA guarantee fee is, how it works, current rates, and how it affects your monthly mortgage payment in 2025.

If you’re considering a USDA loan, you’ve likely seen something called a guarantee fee listed in the closing costs. This small but important fee helps keep USDA home loans available for low- and moderate-income borrowers in rural areas, without requiring a down payment.

In this guide, we’ll explain exactly what the USDA guarantee fee is, how it works, what the current rates are, and how it impacts your total loan cost.

What Are USDA Loans?

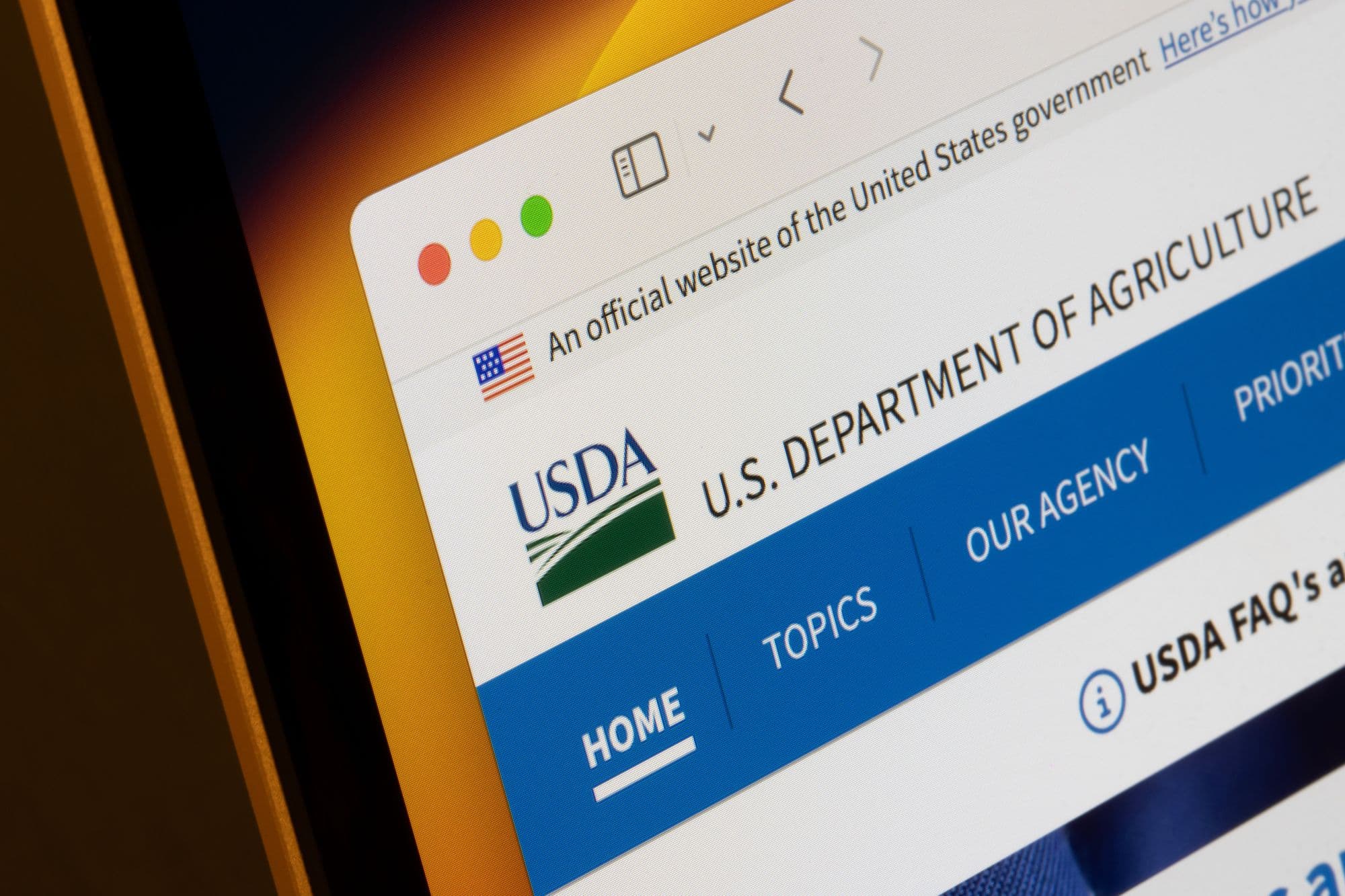

A USDA loan is a government-backed mortgage program offered through the U.S. Department of Agriculture’s Rural Development (USDA RD) division. Its goal is to make homeownership more affordable for low- to moderate-income borrowers in eligible rural and suburban areas.

Unlike conventional loans that require a down payment, USDA loans allow 100% financing, meaning you can buy a home with no money down.

There are two main types of USDA home loans:

1. USDA Guaranteed Loan:

- Issued by approved private lenders (like banks or credit unions).

- Backed by the USDA through a guarantee, this is where the USDA guarantee fee comes in.

- Ideal for most homebuyers who qualify based on income and property location.

2. USDA Direct Loan:

- Funded directly by the USDA.

- Designed for very low-income borrowers who meet stricter eligibility requirements.

USDA loans can be used to:

- Purchase a primary residence.

- Refinance an existing USDA loan into a lower rate.

- Build or repair a home in a qualifying area.

To qualify, both you and the property must meet USDA eligibility rules, including income limits and location requirements, which you can check using the USDA’s eligibility map.

What Is a USDA Guarantee Fee?

The USDA guarantee fee is a cost borrowers pay on USDA-backed mortgages. It serves as insurance for lenders, protecting them if a borrower defaults.

In return, the USDA is able to offer 100% financing with no down payment, competitive interest rates, and more lenient credit requirements than many other loan types.

There are two parts to the USDA guarantee fee:

- Upfront Guarantee Fee: A one-time cost paid at closing (often rolled into the loan).

- Annual Fee: A smaller fee added to your monthly mortgage payment.

These fees are required for all USDA Guaranteed Loans and are similar in purpose to FHA mortgage insurance.

Current USDA Guarantee Fee Rates (2025)

The USDA sets guarantee fee rates each fiscal year. For Fiscal Year 2025, the rates are:

| Fee Type | Rate | Description |

|---|---|---|

| Upfront Guarantee Fee | 1.00% | A one-time fee charged at closing, based on the total loan amount. It can be financed into the loan. |

| Annual Fee | 0.35% | Charged yearly on the remaining principal balance and paid monthly as part of your mortgage payment. |

Example:

If you borrow $250,000 with a USDA loan:

- Upfront fee: 1% × $250,000 = $2,500 (can be financed into the loan).

- Annual fee: 0.35% × $250,000 = $875/year, or about $72.92/month.

As your loan balance decreases, the annual fee amount also drops.

Why Does the USDA Charge a Guarantee Fee?

The USDA guarantee fee exists to make the loan program self-funding. Instead of relying on taxpayer dollars, these fees cover potential losses from borrower defaults.

Because the USDA guarantees the loan for lenders, they can offer lower interest rates and zero-down-payment options to qualified borrowers.

Think of the fee as the cost of accessing more affordable homeownership in eligible rural and suburban areas.

How the USDA Guarantee Fee Works

1. Upfront Guarantee Fee

- Collected at closing or rolled into your loan.

- Financed fees slightly increase your loan balance and monthly payment.

- Typically 1% of your total loan amount.

2. Annual Fee

- Charged on the unpaid loan balance each year.

- Divided into 12 monthly installments as part of your mortgage payment.

- Decreases as your loan balance goes down.

Unlike private mortgage insurance (PMI), the annual USDA fee does not automatically drop off when you reach 20% equity; it stays for the life of the loan unless you refinance.

USDA Loan Fee vs. FHA and Conventional Loans

| Loan Type | Upfront Fee | Annual/Monthly Fee | Down Payment |

|---|---|---|---|

| USDA Loan | 1.00% | 0.35% (annual) | 0% |

| FHA Loan | 1.75% | 0.55% (annual) | 3.5% minimum |

| Conventional Loan (with PMI) | None | 0.5%–1% (varies) | 3–20% |

USDA loans often offer the lowest total cost for buyers who qualify, especially since there’s no down payment required.

Can You Avoid the USDA Guarantee Fee?

No. The USDA guarantee fee is mandatory for all USDA Guaranteed Loans. However:

- You can finance the upfront fee into your loan to avoid paying it out of pocket.

- The annual fee decreases every year as your balance drops.

- Refinancing into a conventional loan (once you reach enough equity) can eliminate the annual fee altogether.

USDA Loan Qualification Requirements

To be eligible for a USDA loan (and thus the guarantee fee), both the borrower and the property must meet USDA guidelines:

- Location: Must be in a USDA-eligible rural or suburban area.

- Income: Must not exceed the USDA’s household income limits for your county.

- Credit: Most lenders require a credit score of 640 or higher.

- Use: The property must be your primary residence.

You can check your eligibility on the USDA property lookup tool.

How the Guarantee Fee Impacts Your Monthly Payment

Let’s look at an example:

| Loan Detail | Amount / Rate |

|---|---|

| Loan Amount | $250,000 |

| Interest Rate | 6.5% |

| Term | 30 years |

| Upfront Fee | $2,500 (rolled into loan) |

| New Loan Total | $252,500 |

| Annual Fee | 0.35% |

Your total monthly mortgage payment would include:

- Principal + Interest: ~$1,596

- Annual Fee Portion: ~$73

- Total Payment: ~$1,669 (excluding taxes and insurance).

Even with the guarantee fee, USDA loans typically remain more affordable than many FHA or conventional options for zero-down borrowers.

Pros and Cons of the USDA Guarantee Fee

How to Lower or Remove a USDA Guarantee Fee

- Refinance: Once you have 20% equity and a solid credit score, refinance into a conventional mortgage to remove the annual fee.

- Pay Down Principal: The faster you reduce your balance, the smaller your annual fee becomes.

- Compare Loan Options: Depending on your finances, an FHA or conventional loan could be cheaper long term.

Concluding Thoughts About USDA Home Loans and Guarantee Fees

The USDA guarantee fee is a small price to pay for one of the few true zero-down home loan programs left. It helps millions of Americans in eligible rural and suburban areas become homeowners without needing thousands in upfront cash.

If you qualify for a USDA loan (not an easy thing to do in the first place), don’t let the guarantee fee deter you; it’s often far less expensive than mortgage insurance on other loan types.

Calculate Your USDA Loan Payment

Find out how much your monthly payment will be with our USDA Loan Calculator — including the guarantee fee and annual fee.

USDA Loan Calculator

Estimate your monthly USDA loan payment, including the 1% upfront guarantee fee and 0.35% annual fee.

Mortgage Calculator

Compare USDA loans to other mortgage types and find your ideal monthly payment.

FHA Loan Calculator

See how FHA loans compare — including mortgage insurance and down payment requirements.