What Does Contingent Mean? Contingent Meaning on a House 2025

Wondering what ‘contingent’ means in real estate? Learn about the contingent meaning and how it impacts buying or selling a property in 2025.

What does contingent mean? In simple terms, it’s a real estate status indicating that an offer has been made on a property, but certain conditions (or contingencies) must be met before the deal is finalized. Let’s break it down and see how “contingent” plays into today’s housing market.

What Does Contingent Mean in Real Estate?

When a property is listed as contingent, it means the seller has accepted an offer from a buyer, but the sale is dependent on specific conditions being met. These conditions are outlined in the purchase agreement and give both the buyer and seller time to ensure the deal is feasible before moving forward.

If the contingencies aren’t fulfilled within the agreed timeframe, the contract can be canceled. Think of it as a safety net for both parties.

Common Contingencies in Real Estate

Contingent offers typically include the following conditions:

1. Financing Contingency

This ensures the buyer secures a mortgage to purchase the property. If the buyer’s loan application is denied, the deal can be canceled without penalties.

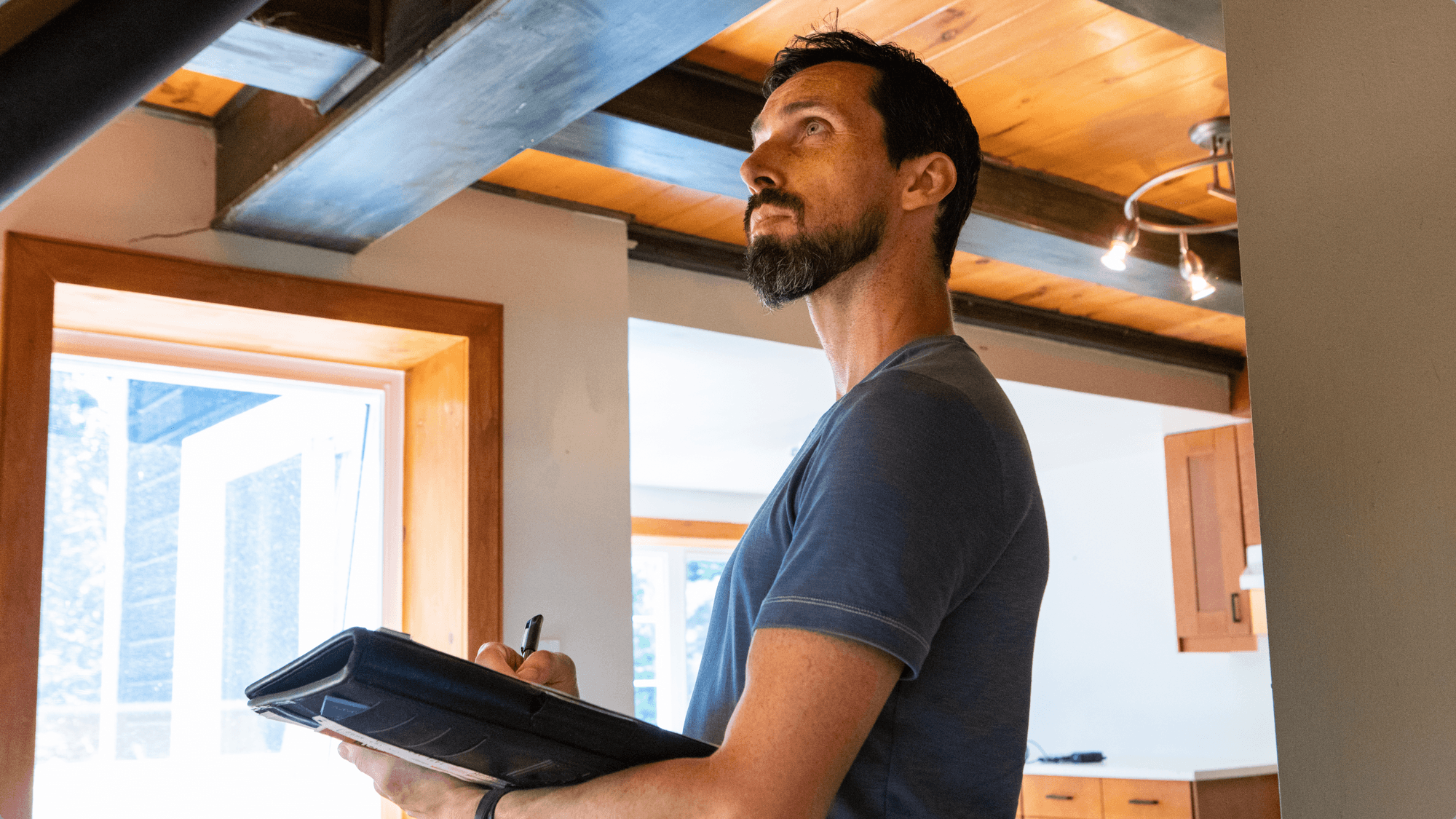

2. Home Inspection Contingency

Buyers often want a professional to assess the property for issues like structural damage or faulty systems. If significant problems are found, the buyer can negotiate repairs, request a price reduction, or back out of the deal altogether.

3. Appraisal Contingency

Most lenders require an appraisal to confirm the home’s value matches or exceeds the agreed purchase price. If the appraisal falls short, the buyer can renegotiate or walk away.

4. Home Sale Contingency

Sometimes, buyers need to sell their current home before they can buy another. This contingency protects the buyer if they’re unable to sell their property in time.

Explore Our Mortgage Calculators

Mortgage Calculator

Easily calculate your mortgage payments with our quick and intuitive tool.

FHA Loan Calculator

Learn about FHA loans and how they can help you purchase your dream home.

VA Loan Calculator

Explore VA loan benefits designed specifically for veterans and active-duty military.

How Does Contingent Differ from Pending?

It’s easy to confuse contingent with pending, but they’re not the same thing.

- Contingent: There are still unresolved conditions that need to be met.

- Pending: All contingencies have been satisfied, and the sale is on track to close.

Can You Make an Offer on a Contingent Home?

Yes, you can! But keep in mind that the seller is already working with another buyer to meet their contingencies. This is where the concept of a backup offer comes into play.

A backup offer lets you step in as the next buyer in line if the current deal falls through. While there’s no guarantee, it can be worth considering if you’re serious about the property.

Frequently Asked Questions (FAQs)

What does contingent mean in real estate?

A property listed as contingent means the seller has accepted an offer, but specific conditions outlined in the contract must be met before the sale is finalized.

Can I make an offer on a contingent home?

Yes, you can submit a backup offer, which will be considered if the current deal falls through.

How is contingent different from pending?

A contingent status means certain conditions still need to be fulfilled, while a pending status indicates all contingencies have been resolved, and the sale is close to completion.