Attacking Veteran Homelessness in the United States

Homelessness in the most advanced country in the world is unacceptable. Allowing military veterans to make up any portion of that is worse.

Roughly 15-20 Americans per 10,000 meet the government definition of homeless. That equates to 500,000+ homeless nightly in the country considered worldwide as the standard for opportunity and prosperity.

Approximately 21 per 10,000 U.S. veterans meet that same definition. That means that a higher percentage of those who pledged to defend our freedoms are without overnight shelter as opposed to the population they swore to protect.

These numbers fluctuate and vary depending on the time and data source. However, the overall trend, regardless of study or methodology, is the same. Veterans have a higher likelihood of becoming homeless than those who are not.

The reasons for homelessness in general are magnified for veterans returning to regular life. While veteran homelessness has decreased 50% since 2009 due to government policies and public awareness, more can be done.

According to Housing and Urban Development (HUD) estimates, over 40,000 veterans are homeless at any given time. Unfortunately, that figure is fluid and twice that many might be affected by homelessness throughout the year.

Mental health programs and charities that assist those with physical injuries help to keep veterans off the streets.

Several nonprofit organizations are dedicated to bettering the lives of veterans and their families. In doing so fewer veterans will suffer the fate of homelessness. We have highlighted two below.

*What’s My Payment has no affiliation with any of the charities listed. We simply admire and respect the work they do.

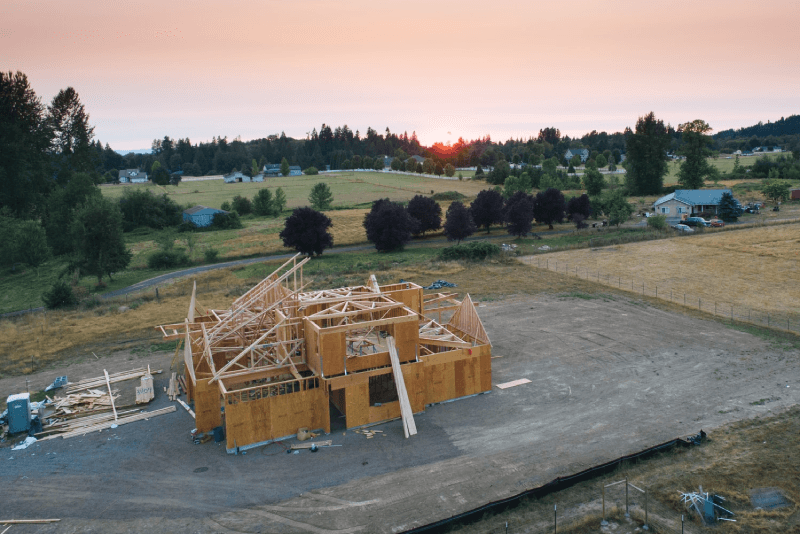

Homes for Our Troops

Website: www.hfotusa.org

Homes for Our Troops (HFOT) builds new homes that are specially adapted for severely injured service members. Their website states their mission:

To build and donate specially adapted custom homes nationwide for severely injured post-9/11 veterans, to enable them to rebuild their lives.

HFOT enables veterans with life-altering disabilities by providing homes designed with their specific needs in mind. HFOT has constructed 320 homes since 2004 with the goal to assist every veteran who qualifies.

Wounded Warrior Project

Website: www.woundedwarriorproject.org

Similarly to HFOT, the Wounded Warrior Project (WWP) assists veterans with service related disabilities, including physical and mental injuries and illness.

WWP is a community of veterans dedicated to transitioning service members to civilian life. The return to normalcy after a life in the military can often be an enormous challenge. A challenge that has contributed to the number of homeless veterans. By helping veterans integrate into society, WWP is reducing the amount of veterans without adequate housing.

Veteran Homeownership Loans

Helping veterans and active service members to budget and plan for homeownership is a core objective of What’s My Payment. Our VA loan calculator was built specifically to account for the nuances of VA loans. Additionally, our VA refinance calculators were designed to demonstrate the savings available by refinancing with a VA loan.

VA Refinance Calculators: IRRRL Cash-out

For veterans looking for more information on the benefits of VA home loans, please visit our VA loan resource center.