VA Construction Loans Explained

Having your dream home built is more attainable than you might think.

If you’ve ever been house hunting before, you’re well aware that it can be a long and frustrating process. I don’t know about you, but having to make appointment after appointment to drive around town and take a tour through other people’s personal space is not how I like to spend my weekends.

While touring houses, you may have even asked yourself questions like:

Is this carpet older than I am?

Has the architect of this place actually used a kitchen before?

Why does it smell like a hospital cafeteria in here?

Finding a place you actually want to purchase isn’t even half the battle. Now you have to put an offer in and hope that you don’t have to engage in a bidding war that will drive the price up and your spirits down. Heaven knows you don’t want to have to start this process over again.

An alternative to house hunting

What if there was an easier way to put yourself in a new home where you didn’t have to inherit someone else’s mess? A way where you don’t have to worry about whether or not the previous owners treated the plumbing like it was a rental car. You won’t have to gut the bathrooms or redo the kitchen. Everything will be the exact way you want it from day one.

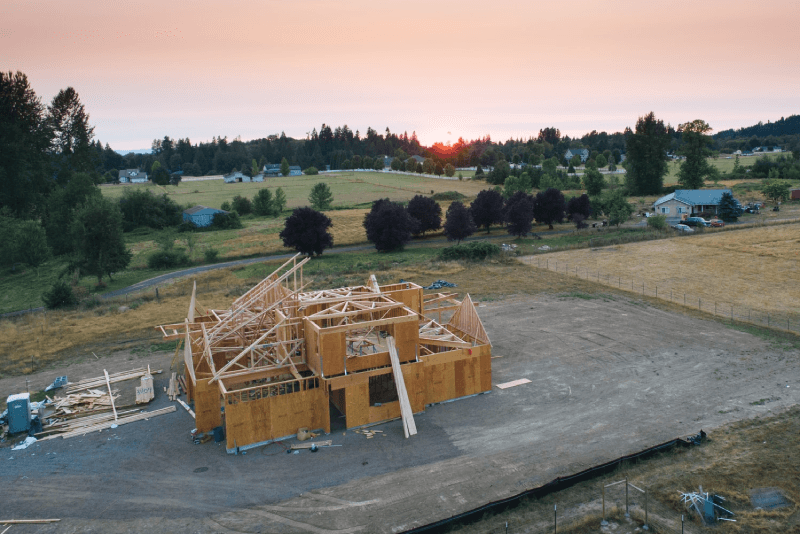

I’m talking about having a home built from scratch! I know what you’re thinking. The price to have a home built must be astronomical, right? It turns out that is not necessarily true.

In fact, Redfin estimates the median sale price of homes in the U.S. is $333,942. With that in mind, Home Advisor estimates that the cost to have a house built is between $163,667 and $477,915.

Granted, the cost to build a new home does not include the land that it will go on, but seeing those numbers dispels the common belief that it’s unattainable to have a house built just for you.

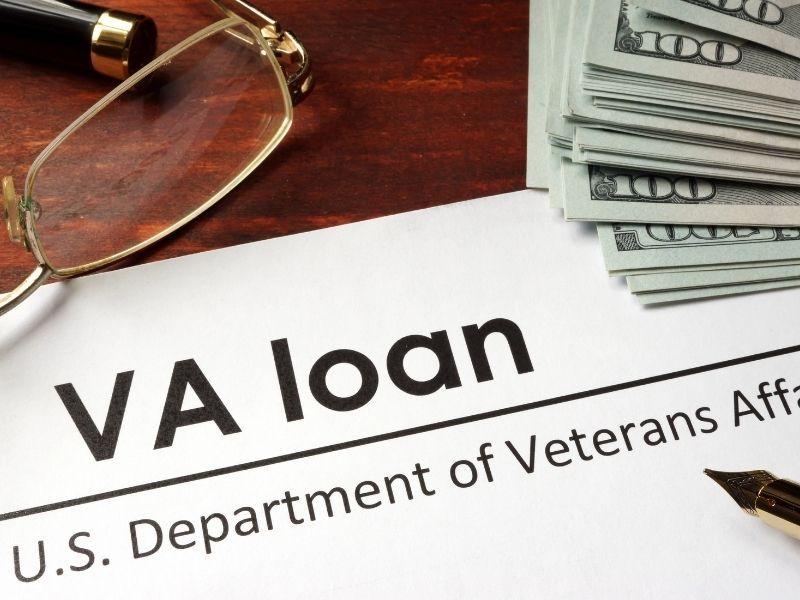

Additionally, military benefits provide significant advantages for VA construction loans as opposed to conventional construction loans. For a regular construction loan, lenders typically require a higher down payment, but VA construction loans don’t require a down payment or mortgage insurance.

What is a VA construction loan?

To put it simply, a VA construction loan allows a qualified military borrower to include the price of building a new home into their mortgage.

With a typical VA loan your lender doles out a single lump sum to cover the cost of an existing house, whereas a VA construction loan will be paid out in multiple disbursements based on the milestones of the build timeline.

Are there different types of VA construction loans?

In most cases, a borrower will need to apply for a loan for the construction phase of the home-build, and a separate loan for the land that the home will be built on. This leads to two separate closing dates and is commonly referred to as a “two-close loan”.

The second loan type features a single close date and as you may have guessed, it’s referred to as a “one-time close loan”. With this type of loan it’s the seller’s responsibility to obtain building permits and other pertinent paperwork as a requirement for final loan approval.

Do I need to use a VA-approved builder?

In order to utilize a VA construction loan, you will need to pick a builder that’s been registered by the VA. However, if you find a builder you like that is not currently registered with the VA, you can ask them to register for a VA Builder ID number and in most cases they will be accepted within a few business days.

It’s important to note that the VA does not approve builders based on their reputation or merit as contractors. Builders must be licensed and insured but registering with the VA only requires a few simple forms, so you will still need to do due diligence as you consider what construction company to go with.

The list of VA approved builders can be found by utilizing the Veterans Information Portal.

You should also note that a complete set of plans and building specs must be submitted with your application, so you’ll need to work with a builder before applying. It’s required that your loan is closed before the beginning of construction and approval can take up to two months, so plan accordingly.

Where can I get a VA construction loan?

Any VA-approved lender can issue you a VA construction loan, however it’s up to each individual lender to decide which VA loan products they offer. That is to say that just because a lender is capable of offering VA construction loans, doesn’t necessarily mean that they do.

Are there credit score requirements?

The VA does not have minimum credit score guidelines, so you should not let credit issues discourage you from applying. The VA urges lenders to review an applicant’s entire profile before rendering a decision.

That being said, lenders generally like to see a score of above 640, so you can use that example to see how you’ll stack up.

You can learn more about VA loan requirements here.

Are there restrictions on what kind of house I can have built?

Regulations on the type of home you can have built will come from your lender, and not directly from the VA. Lenders will have different policies regarding whether or not they’ll approve a manufactured or mobile home, as opposed to a typical house built from scratch.

Lenders tend to view VA construction loans as a higher risk investment so it’s important to shop around to find a lender with building standards that fit your vision.

Does this type of loan increase the VA funding fee?

No, utilizing a VA construction loan will not impact your VA funding fee positively or negatively.

In some cases, veterans who have been injured during their service are exempt from having to pay the VA funding fee. You can find a full list of exemption requirements here. If you do qualify for an exemption to the funding fee, you should discuss this with your loan officer promptly.

Please note that if you are subject to paying the VA funding fee, that it must be paid within 15 days of closing.

Do I have to make payments during construction?

You aren’t required to make payments on your loan until the construction of your home is complete. You can delay your payments up to 12 months, but this can be tricky because the loan will still need to be paid back within the remaining term of the mortgage.

For instance, if you were to take out a standard 30 year loan and it took your contractor a full year to build your house, you would only have 29 years left to complete 30 years worth of payments.

For this reason, it’s generally advisable to make payments during the construction period so that you don’t fall behind, but it is not required.

A final word on VA construction loans

A VA construction loan will require a few extra steps and some determination, but the end result will potentially be the house of your dreams!

To find out what you can afford, use our VA mortgage calculator.