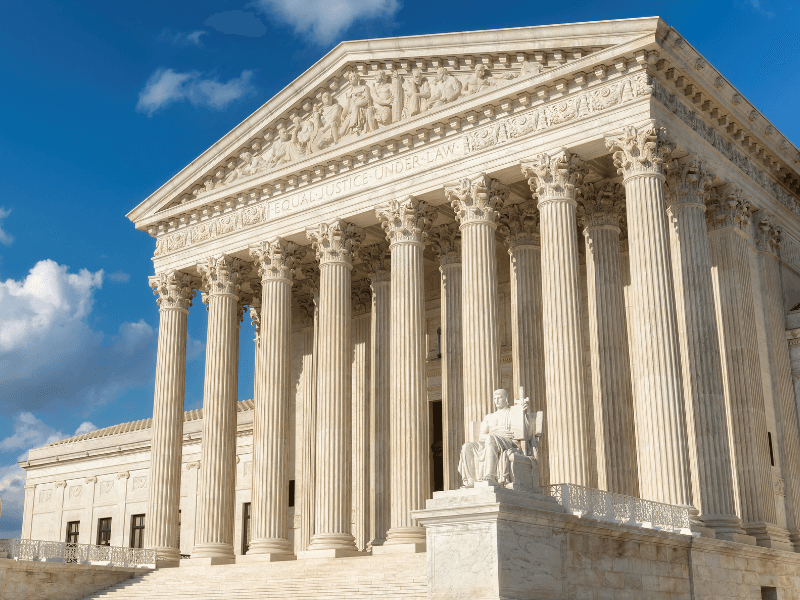

Supreme Court Overrules Eviction Moratorium

See how this new ruling will impact millions of renters.

It was announced on August 26th, 2021 that The Supreme Court reached a ruling that removed eviction protections for most U.S. citizens. The protections had been part of a program put in place by the CDC in an effort to assist citizens who have been financially impacted by the COVID-19 pandemic.

The decision comes after an association of realtors, landlords, and other plaintiffs challenged the nationwide eviction moratorium in district court, asserting that the policy was unlawful and that the CDC does not have authority to enact and enforce such a policy.

As it turns out, The Supreme Court agrees with that assessment, citing that the eviction moratorium was enacted by the CDC using a dated statute that does not grant the CDC the authority that it claims.

Is the eviction moratorium completely dead?

There is still some speculation that another moratorium could be in the works. In fact, The Supreme Court’s decision specifically states that a moratorium of this type would need to be enacted by Congress, so we could see new legislation in the coming weeks.

As of this writing, there are also multiple states like California and New York that have their own state laws regarding evictions in place.

You can look up your state's eviction protection here.

What should I do if I’m in danger of being evicted?

Billions of dollars in aid are currently available for rental assistance, but these programs are set to expire soon depending on what state you’re in.

You can learn more about how to apply for emergency rental assistance here.

The emergency assistance program can help to pay for rent, utilities, energy costs, and in some cases moving expenses if you’re forced to move.

Potential impact on the real estate market

It’s tough to tell without a crystal ball how this might impact the real estate market and the economy as a whole, but I am hearing a few different speculative scenarios from real estate experts.

The pandemic and fear of another possible eviction moratorium on the horizon have some landlords wary and ready to get out from under their rental properties. Since the real estate market is white-hot and mortgage rates have seen all-time lows recently, we could see a large number of landlords opt to sell their properties and invest elsewhere. This could mean a rash of new inventory would hit the market which could potentially cool things off.

On the other hand, there would be potentially thousands of evicted Americans who are once again seeking a new rental, and that demand is likely to increase the cost of rent in major metropolitan areas. The ripple effect could see middle-class families continue to move away from bigger markets to find work and residency elsewhere.

A final word on the moratorium

The debate regarding the Biden administration’s eviction moratorium rages on as the pandemic continues to wreak havoc. We will keep a close eye on new developments and report back with new findings.