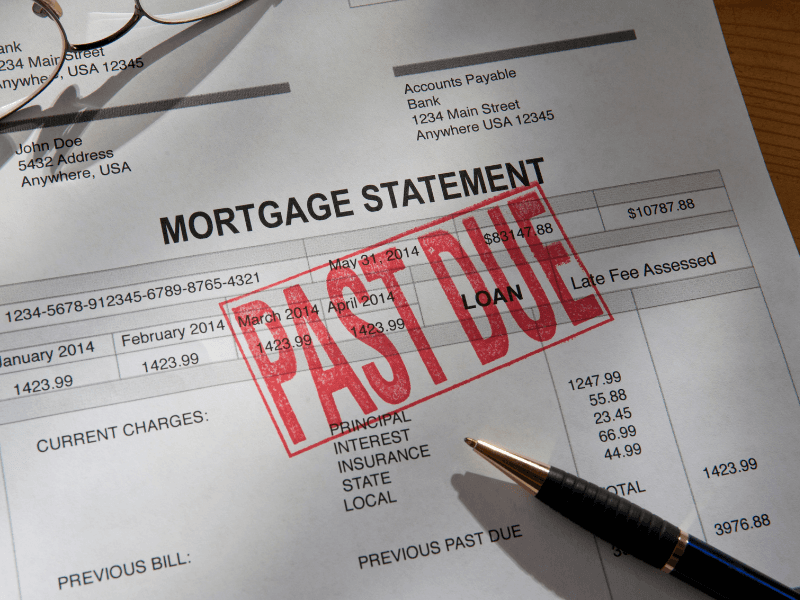

Mortgage Delinquency Soars to Historic High

Homeowners who needed government help to prevent losing their home because of COVID-19 received it. Foreclosure moratoriums and forbearance programs kept families in their homes while the world attempted to regain normalcy, which includes family members returning to work and reestablishing pre-COVID incomes.

The protections have kept foreclosure rates historically low. However, the fallout from COVID-19 includes millions of homeowners who are behind on their mortgage payments. At some point those two statements cannot coexist.

The Biden administration is “encouraging” mortgage servicers to work with delinquent borrowers by pushing missed payments to the end of the loan term or by modifying the loan entirely to reduce the homeowner’s monthly payment burden. For those who have not recovered financially enough to afford their modified payment, foreclosure could be what’s next.

“The last time we saw this high of a level was back in 2008 and 2009 during the financial crisis. But what is different this time is that the foreclosure rate is at a historic low because of the forbearance program.”

- Lawrence Yun, Chief Economist - National Association of Realtors

Foreclosures are a difficult topic to cover. From a macro level, they are essential and a critical piece of the wheel that makes up America’s housing market. Dig deeper though, and a foreclosure is often a family losing their home. The current and previous administrations took drastic steps to keep as many families as possible from experiencing the devastation of being removed from their homes. However, the market must eventually take over, which means losing a home will be reality for many.

The housing market remains scorching hot. A lack of foreclosures on the market and sellers not listing because they are in forbearance is affecting the number of homes for sale and driving prices up. It’s sad to think of families losing their homes, but our housing market functions best with an appropriate amount of foreclosures.

2022 will see the end of many of the protections provided by the federal government. The hope is as many homes as possible can be saved by loan modifications and lowered monthly payments. However, foreclosures are inevitable.

Related

- See if you can lower your payment by refinancing.Want to buy a foreclosure? Get pre-approved.

Read More

Mortgage Rate Predictions 2025: Here’s What Experts Are Predicting

See 2025 mortgage rate predictions from experts like Fannie Mae & NAR. Learn what to expect if you're buying, refinancing, or investing.

2025 FHA Interest Rates

Learn how FHA interest rates work, what affects them, and how to get the best rate, especially if you're a first-time buyer or have lower credit.

Massive Layoffs Continue in the Mortgage Industry

The rise in rates continues to take it's toll.

Mortgage Demand Falling, What Does It Mean for Homebuyers?

In recent months, mortgage rates have been on an upward trend. However, they are now starting to fall. Learn what this means for homeowners and real estate investors.

Julia Gordon Sworn in as FHA Commissioner

Learn about Julia Gordon who was recently sworn in as the FHA Commissioner under the HUD Secretary.

Is a foreclosure crisis looming?

The CFBP was formed amidst the ashes of the housing market’s demise over a decade ago. Are they worried another crash is on its way?