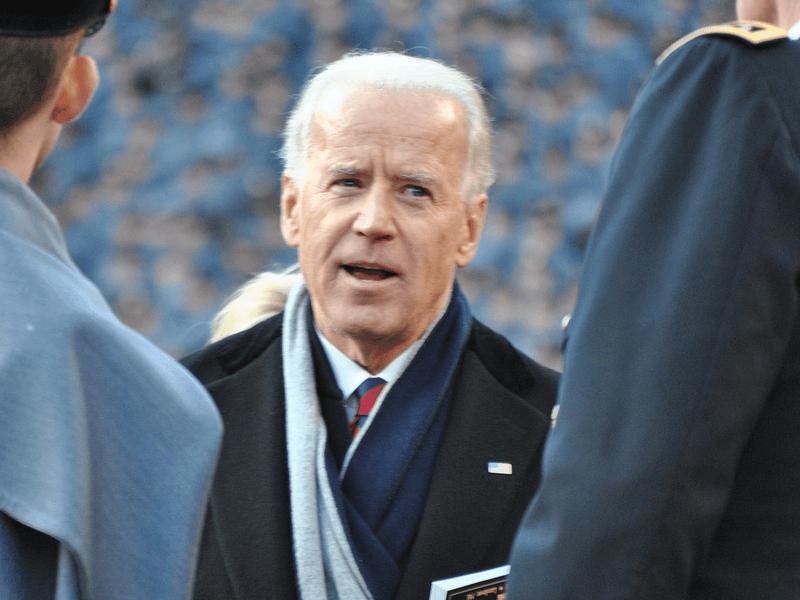

Biden Loosens Mortgage Restrictions for Borrowers with Student Loans

Hopeful homebuyers with student loans might have a better chance of securing a mortgage with these new guidelines.

It was recently announced that new FHA loans will have improved guidance for how to handle student loan debt. Previously, if your student loans were in deferment or otherwise did not carry a monthly payment, FHA mortgage lenders were required to count 1% of your outstanding student loan balance against your debt-to-income ratio (DTI). New guidelines established in August of 2021 will cut that in half.

FHA affordability is not black and white, but FHA lenders like to see a DTI less than 43%, which is to say your total monthly debt payments do not exceed 43% of your gross monthly income. If a potential FHA homebuyer has $75,000 in student loans that won’t go into repayment for a couple of years, mortgage lenders were required to use a $750 monthly payment when qualifying the borrower. The new rule that goes into effect on Monday cuts that number to $375. While that might not seem like much, $375 per month is about $80,000 in purchase power at today's mortgage rates.

When does the new rule apply?

If you have student loans, they will typically show up on your credit report. If you are in the repayment period, the payment on your credit report is usually the minimum amount required to repay the loan within your given term and is what your lender will include in your DTI. In cases such as these, the rule won’t apply.

However, if your loan is not in repayment, including deferment, forbearance, or other agreement with the lender, your credit report may or may not show a payment. If it shows a payment, your mortgage lender will use that payment in your DTI calculation unless you can document that your payment will in fact be lower. Again, in this situation the rule will not apply. Either your actual documented payment or the payment displayed on your credit report will be used.

The final scenario is where the new 0.5% of the outstanding balance applies. If your student loans appear on your credit report but shows a payment of $0, which can happen when the loan is not in repayment, the lender will multiply the outstanding balance times 0.5% and include that figure in your DTI. In today’s environment every $100 in payment savings is about $20,000 in buying power. If you have significant student loan balances, the amount of home for which you are approved could increase substantially.

Your FHA debt-to-income ratio is an important consideration when determining how much you can spend when using an FHA loan. Many first-time homebuyers are younger borrowers entering the workforce with student loans that are yet to enter repayment. Rather than being unfairly affected by an unrealistic student loan payment, the new guidelines outlined in mortgagee letter 2021-13 will allow more home shoppers to fulfill their homeownership dreams.