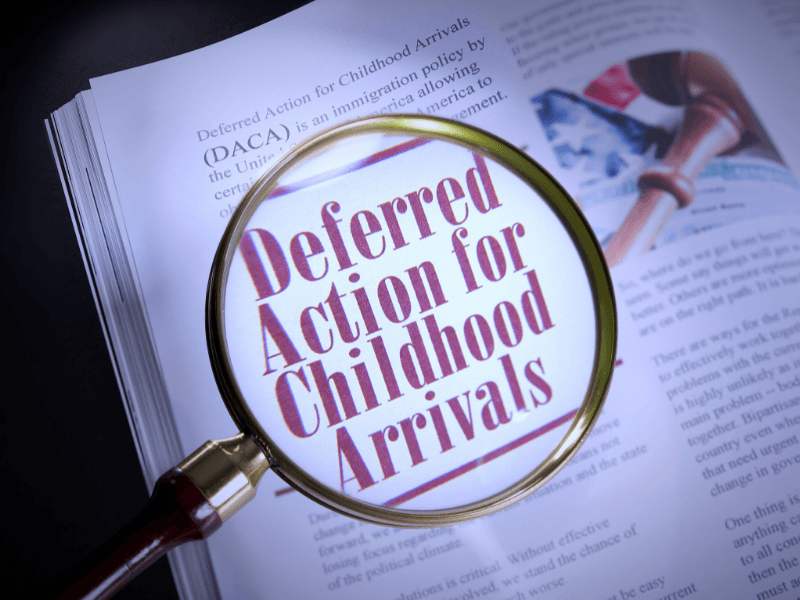

FHA Loan Eligibility Clarified for DACA Recipients

U.S. Department of Housing and Urban Development issues mortgagee letter detailing FHA loan eligibility for non-permanent residents, including DACA recipients.

Mortgagee Letter 2021-12

One day prior to inauguration day, the Trump Administration waived an entire section of the FHA handbook in order to eliminate confusion as to whether or not some non-residents could obtain an FHA loan. The section in question dealt with FHA’s lawful residency policies for FHA loan endorsements. The waiver applied to FHA loans made January 19, 2021, or later.

Last month the Department of Housing and Urban Development (HUD) issued mortgagee letter 2021-12 with the purpose of clarifying FHA loan eligibility for Deferred Action for Childhood Arrivals (DACA) recipients. The letter dated May 28, 2021, also amends documentation requirements for non-permanent FHA homebuyers.

The HUD clarification letter takes effect July 26, 2021. However, FHA lenders may implement the new requirements immediately.

FHA Residency Requirements

FHA has long held requirements for homebuyers to maintain residency and employment status when determining eligibility for an FHA loan. Mortgage lenders are required to include documentation whether the borrower is a permanent or non-permanent resident.

In 2012, DACA was announced. FHA’s residency guidelines did explicitly cover situations in which the Department of Homeland Security would permit potential FHA homebuyers to maintain residency during this period of deferred action. As long as DACA eligibility is maintained and the homebuyer is eligible to work, mortgagee letter 2021-12 states the potential homeowner may apply for an FHA loan.

FHA loans are one of the easiest ways for young people to become homeowners. While homebuyers of any age are eligible for FHA financing, younger borrowers tend to have less savings and tangible assets. FHA loans require only a 3.5% down payment, have competitive interest rates, and are available in all 50 states and U.S territories. FHA loan payments include taxes and insurance, making it easier for new homebuyers to budget and plan.

Because of the low down payment requirements, FHA loans make homeownership more realistic for millions of Americans. Non-citizens are eligible, too, as long as the residency requirements in the HUD handbook are met. Resident borrowers, both permanent and non-permanent, must meet the same underwriting terms and conditions as everyone else. If the resident is able to afford an FHA loan and qualify financially, they can use an FHA loan to buy a home.

FHA Handbook 4000.1 Section II.A.1.b.ii(A)(9)(b)

The following is the updated HUD handbook section amended by mortgagee letter 2021-12.

(b) Non-Permanent Residents

A Borrower who is a non-permanent resident may be eligible for FHA- insured financing provided:

- the Property will be the Borrower’s Principal Residence;

- the Borrower has a valid SSN, except for those employed by the WorldBank, a foreign embassy, or equivalent employer identified by HUD;

- the Borrower is eligible to work in the United States provided the borrower provides either:

- the Borrower is eligible to work in the United States provided the borrower provides either:

- an Employment Authorization Document (USCIS Form I-766) showing that work authorization status is current;

- a USCIS Form I-94 evidencing H-1B status, and evidence of employment by the authorized H-1B employer for a minimum of one year;

- evidence of being granted refugee or asylee status by the USCIS; or

- evidence of citizenship of the Federated States of Micronesia, the Republic of the Marshall Islands, or the Republic of Palau; and the Borrower satisfies the same requirements, terms and conditions as those for U.S. citizens.

If the Employment Authorization Document (USCIS Form I-766) or evidence of H-1B status will expire within one year and a prior history of residency status renewals exists, the Mortgagee may assume that continuation will be granted. If there are no prior renewals, the Mortgagee must determine the likelihood of renewal based on information from the employer or the USCIS.

A Borrower residing in the United States by virtue of refugee or asylee status granted by the USCIS must provide documentation:

- Employment Authorization Document (USCIS Form I-766) or USCIS Form I-94 indicating refugee or asylum status, or

- USCIS Form I-797 notice indicating approval of a USCIS Form I-589, Application for Asylum or Withholding of Removal substantiating the refugee or asylee status.