Escrow Meaning: A Simple Guide for Homebuyers in 2025

Learn the meaning of escrow in simple terms. Discover how escrow works in mortgages, why it matters, and how it helps manage property taxes and insurance with ease.

When learning about mortgages for the first time, you’re bound to stumble across some confusing terms. One of the most commonly heard terms is “escrow.” It sounds complicated, but it doesn’t have to be. Let’s break it down in plain English so you can confidently navigate your homebuying journey.

What Is Escrow?

Escrow is like a secure holding spot for money or documents while a real estate transaction is being finalized. Think of it as a neutral middle ground that protects both the buyer and the seller during the process.

For example, when you’re buying a home, your earnest money deposit (a show of good faith) usually goes into an escrow account. The escrow company holds onto it until all the agreed-upon conditions, like home inspections or loan approvals, are met.

How Does Escrow Work in Mortgages?

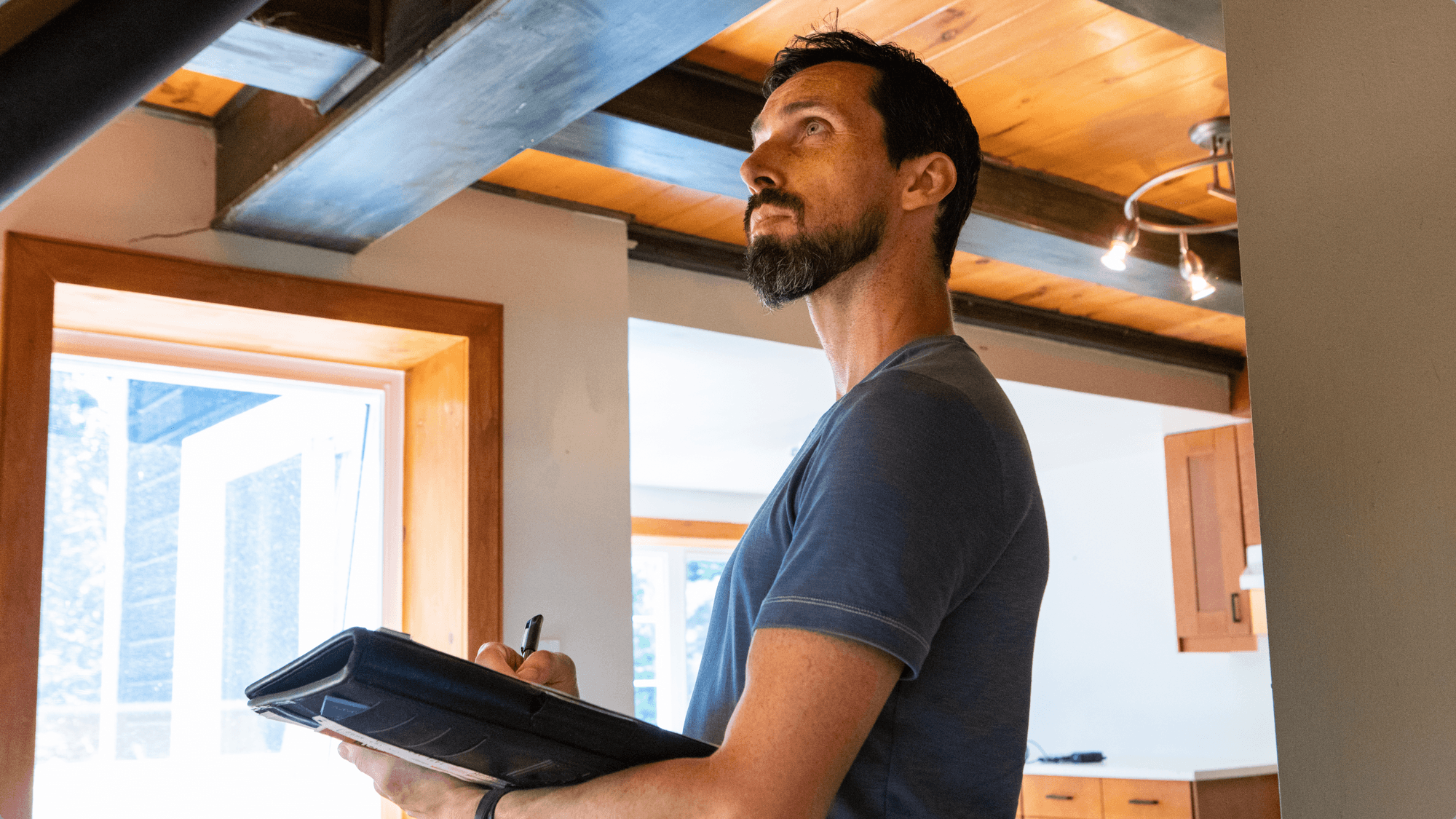

Once the sale is complete, escrow doesn’t disappear—it just shifts gears. In the world of mortgages, your lender may set up an escrow account to manage your property taxes and homeowners insurance. Instead of paying these big expenses in one lump sum, you’ll contribute a little with each monthly mortgage payment. The lender collects these funds in the escrow account and pays the bills on your behalf.

Why? It’s a win-win.

- For you: No scrambling to save for surprise bills.

- For the lender: They know the taxes and insurance will be paid, protecting their investment in your home.

Explore Our Mortgage Calculators

Mortgage Calculator

Easily calculate your mortgage payments with our quick and intuitive tool.

FHA Loan Calculator

Learn about FHA loans and how they can help you purchase your dream home.

VA Loan Calculator

Explore VA loan benefits designed specifically for veterans and active-duty military.

Why Escrow Matters

Escrow keeps everything running smoothly, whether you’re buying a home or paying for it. It ensures that funds are handled securely, deadlines are met, and you avoid nasty surprises.

Without escrow, you’d be on the hook for managing these payments on your own, which can get tricky. Having that escrow account is like having a built-in financial organizer for your home expenses.

Wrapping Up

Escrow is all about security and simplicity. Whether you’re buying a home or managing mortgage payments, escrow acts as a safeguard to ensure all the financial pieces fall into place. It’s one less thing for you to worry about on your homeownership journey.

Frequently Asked Questions (FAQs)

1. Do I have to have an escrow account?

In many cases, yes—especially if your down payment is less than 20%. Lenders often require escrow accounts to make sure taxes and insurance are covered. However, some borrowers with larger down payments can request to waive escrow.

2. What happens if there’s extra money in my escrow account?

At the end of the year, your lender will review the account. If there’s more money than needed, you’ll typically get a refund or a credit toward your next year’s payments.

3. Can my escrow payment change?

Yes. If your property taxes or insurance premiums increase or decrease, your escrow payment will adjust accordingly. You’ll get a notice from your lender explaining any changes.