What Is An Assumable Mortgage and How Does It Work?

Learn what an assumable mortgage is, how it works, which loans qualify, and the pros and cons to see if it’s right for your next home purchase.

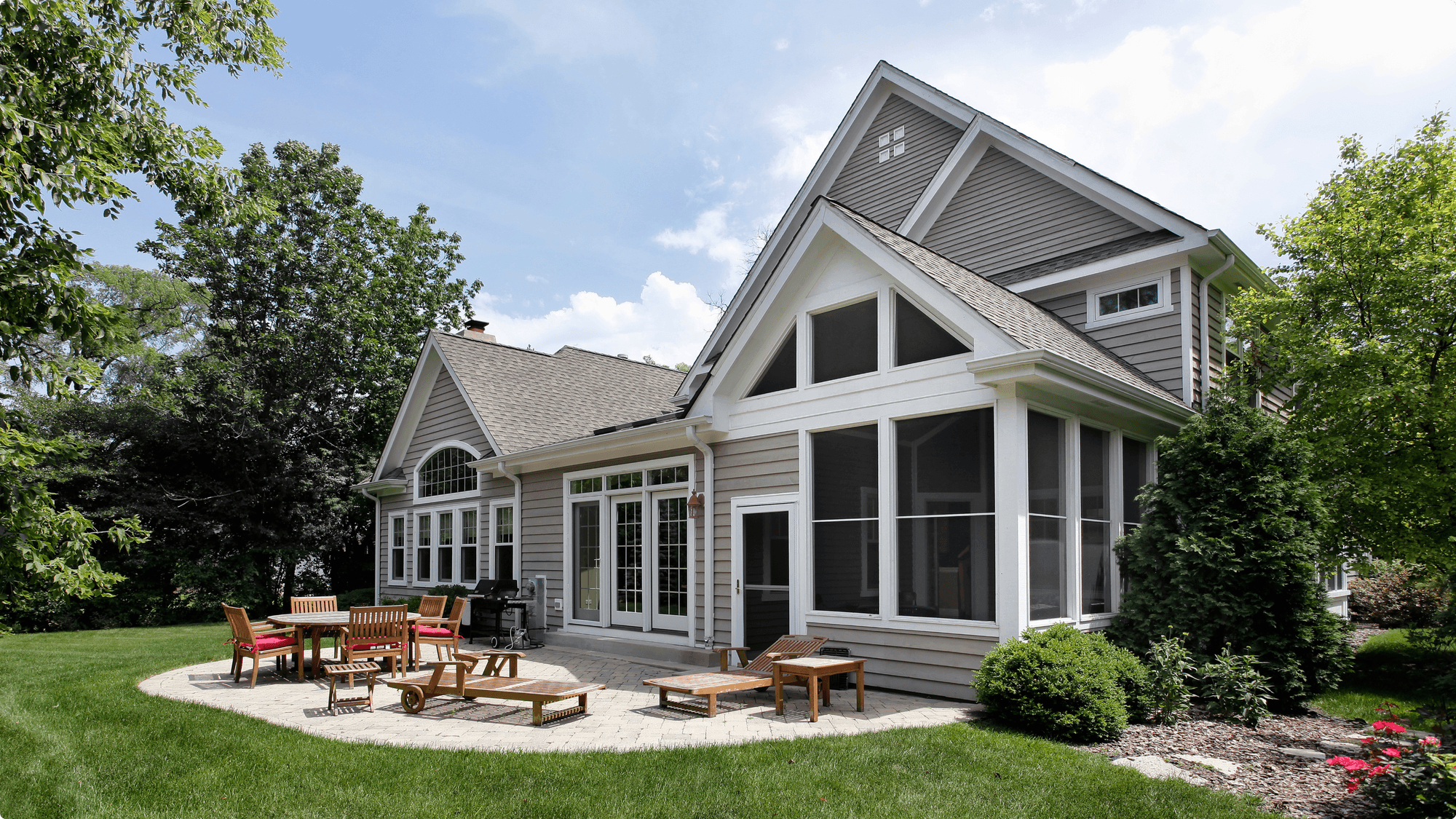

Buying a home usually means taking out a brand-new mortgage, but that’s not always the case. With an assumable mortgage, a buyer can take over the seller’s existing loan, often keeping the same interest rate and repayment terms. In a housing market where rates remain higher than in recent years, this option has caught the attention of both buyers and sellers looking for an edge.

In this guide, we’ll break down exactly what an assumable mortgage is, how it works, the pros and cons, and when it might make sense. By the end, you’ll know whether assuming a mortgage could be the right move for your next home purchase.

What Is an Assumable Mortgage?

An assumable mortgage is a home loan that a buyer can take over, or “assume,” from the seller. Instead of applying for a brand-new mortgage, the buyer agrees to continue making payments on the seller’s existing loan. This transfer includes the remaining loan balance, the original interest rate, and the repayment terms outlined in the mortgage agreement.

This can be a major advantage in today’s housing market. For example, if the seller locked in a mortgage at 3% interest several years ago and current rates are above 6%, the buyer could save thousands over the life of the loan by assuming it. Because of this, assumable mortgages are especially attractive in high-rate environments where buyers are searching for ways to make homeownership more affordable.

How Does an Assumable Mortgage Work?

An assumable mortgage works by transferring the seller’s existing home loan to the buyer, instead of the buyer taking out a new mortgage. The process is straightforward but requires lender involvement to ensure the buyer qualifies.

Here’s how it typically works:

- Buyer and Seller Agreement: The buyer and seller agree on a purchase price. The buyer then applies to assume the seller’s mortgage rather than applying for a new one.

- Lender Approval: The lender reviews the buyer’s credit, income, and financial stability to confirm they can meet the loan obligations. Approval is required before the assumption is finalized.

- Title and Loan Transfer: Once approved, the property title transfers to the buyer, who continues making monthly mortgage payments under the original loan’s interest rate and terms.

Why It Matters:

Unlike a traditional mortgage, an assumable loan lets buyers skip the process of securing a brand-new loan, which can mean:

- Lower interest rates if the original loan was locked in years ago

- Potentially lower monthly payments

- Savings on closing costs compared to starting a new mortgage

This combination makes assumable mortgages especially appealing when current market rates are higher than historic ones.

Pros and Cons of Assumable Mortgages

Which Loans Are Assumable?

Not every mortgage can be transferred, but several government-backed loan programs allow for assumptions. Knowing which loans qualify is key if you’re considering this option.

1. FHA Loans

Federal Housing Administration (FHA) loans are fully assumable with lender approval. Buyers must still meet the lender’s credit and income requirements, but this option can help secure a lower interest rate locked in by the original borrower.

2. VA Loans

Veterans Affairs (VA) loans are assumable as well. However, there’s an important caveat: if a non-veteran assumes the loan, the original borrower may lose their VA loan entitlement until the assumed loan is paid off. This can affect the seller’s ability to qualify for another VA-backed mortgage.

3. USDA Loans

Some U.S. Department of Agriculture (USDA) loans are assumable, but approval depends on the lender’s terms and conditions. USDA assumptions may require the buyer to meet specific income limits tied to rural housing programs.

4. Conventional Loans

Most conventional mortgages are not assumable. The only exception is when the loan agreement specifically includes an assumption clause, which is relatively rare.

If you’re exploring an assumable mortgage, focus on FHA, VA, and USDA loans, as these are the most common types that allow for assumption with lender approval. Conventional loans generally don’t qualify.

Who Benefits Most from an Assumable Mortgage?

An assumable mortgage is ideal for:

- Buyers looking for a lower interest rate than current market rates.

- Sellers who want to make their home more attractive in a competitive market.

- Homebuyers with cash available for a potential large down payment.

If you fall into one of these categories, it might be worth exploring assumable mortgage options!

How to Find Assumable Mortgages

Assumable mortgages aren’t always obvious, but with the right approach, you can definitely find them. Here are the most reliable ways to find properties with assumable loans:

1. Check Home Listings

Some real estate listings will clearly state if the seller’s loan is assumable. Look for keywords like “FHA assumable” or “VA assumable” in the property description. These are strong indicators that the current mortgage may be transferable.

2. Ask the Seller Directly

If you’re interested in a home financed with a government-backed loan (FHA, VA, or USDA), ask the seller or their real estate agent whether the loan is assumable. Even if it’s not mentioned in the listing, the seller may be open to the option.

3. Work With a Mortgage Professional

Mortgage brokers and lenders often know which homes in your area carry assumable loans. A professional can save you time by filtering properties and explaining the qualification requirements.

4. Network With Real Estate Agents

Experienced real estate agents are another valuable resource. They frequently encounter assumable loans in their markets and can help you identify opportunities that aren’t widely advertised.

Bottom Line

An assumable mortgage can be a smart way to buy a home, especially in today’s high-interest-rate environment. By taking over the seller’s existing loan, you may lock in a lower rate, reduce monthly payments, and even save on closing costs. But it’s not for everyone. Assumptions require lender approval, and not all loans qualify, so it’s important to understand the process before making a decision.

If you’re exploring homeownership, weigh the pros and cons of an assumable mortgage alongside traditional financing options. Talking with a knowledgeable lender or real estate professional can help you figure out whether assuming a loan is the right option for you.

In the end, an assumable mortgage is one more tool that can make buying a home more affordable, and knowing how it works gives you an advantage in a competitive housing market.

FAQs

1. Do you need good credit for an assumable mortgage?

Yes. The lender will review your credit score, income, and debt-to-income ratio before approving the loan transfer.

2. Can a VA loan be assumed by a non-veteran?

Yes, but the original veteran seller could lose their VA entitlement unless the buyer is also a veteran.

3. How long does it take to assume a mortgage?

It typically takes 30-60 days, depending on lender processing times and buyer approval.

![The NACA Program: What It Is and If It’s Right for You [2025 Review]](/_next/image/?url=https%3A%2F%2Fs3-us-west-2.amazonaws.com%2Fwhatsmypayment.com%2Fcontent%2Fimages%2F2025%2F03%2FThe-NACA-Program-What-It-Is-and-If-It-s-Right-for-You--2025-Review-.jpeg&w=3840&q=75)