Average Mortgage Amount Continues to Skyrocket

The red-hot real estate market continues to rage on, while a recent trend shows that American consumers are borrowing higher amounts than ever before to purchase homes.

Another record high was set for the average mortgage loan amount, setting the new bar at $395,200. This average mortgage amount began to creep up in the spring of 2020 and since then, has steadily climbed to this record-breaking number.

So why has the amount increased so much?

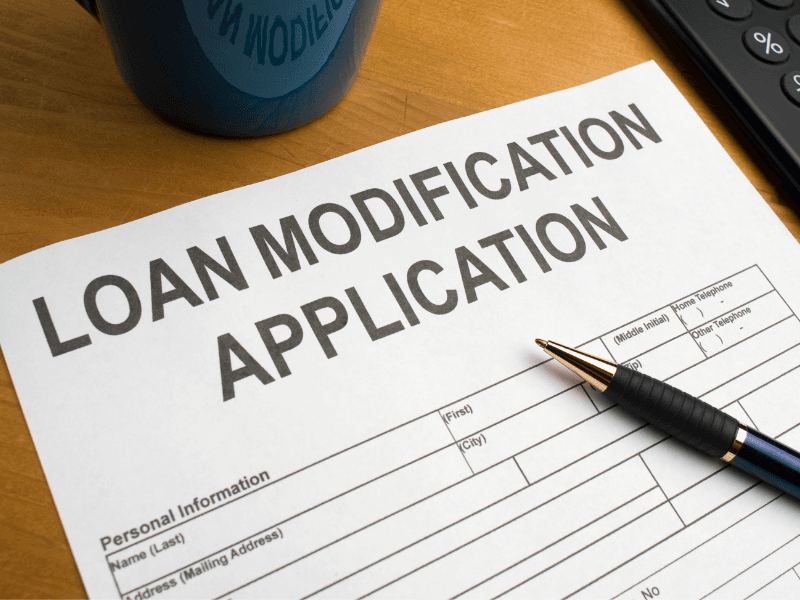

One factor for the nationwide increase in new mortgage loans is the dramatic pace at which interest rates have fallen over the past few months, hitting record lows time and again. The Federal Reserve’s bond buying spree has played a primary role in this trend since the central bank spent billions of dollars on mortgage bonds each month.

Because monthly payments are typically lower when interest rates are down, a person can have a substantial loan balance, but not have to pay as high a monthly payment as would be the case if interest rates were running high or even average. This makes it easier for hopeful borrowers to be approved for loans in greater amounts.

Another factor in the equation is attributable to the simple laws of supply and demand. Since the beginning of the pandemic, mortgage rates have hit record setting lows numerous times. As rates have plummeted, we’ve seen a sharp increase in the amount of buyers flooding the market.

Conversely, the supply of homes on the market can’t keep up with the amount of buyers. Potentially because homeowners are nervous to make a major financial decision amidst the uncertainty of the pandemic. It has also been speculated that more homes aren’t on the market because of the number of homeowners that fall into the older at-risk category for COVID-19. It’s not a great time for baby boomers to be giving strangers tours of their home in large numbers.

Things to consider before taking out a loan

It might seem like good financial sense to capitalize on rates while they’re low, but there are a few things worth considering before you jump in.

As mentioned above, we’re in the midst of a seller’s market, which means home prices will be higher than you’d usually expect to pay. So even though you might be saving money on your mortgage rate, you might also be overpaying for a home.

Additionally, it’s important not to let your realtor or broker pressure you to borrow more than you’re prepared to. Set your budget carefully and don’t borrow more money than you need, just because you can.

A lot of home buyers tend to over leverage themselves and set a budget that they can technically afford, but doesn’t leave much room for error. It’s always good to leave a cushion that will allow you to save, invest, and put money into an emergency fund in case disaster strikes. A mortgage calculator can help you set your budget by giving you a visualization of the numbers so you can see what would be comfortable for you.

A final word on record breaking borrowing

It’s likely that 2021 will see mortgage rates rise so if you’re in the market to purchase or refinance a home, right now is a good time to do it, provided that you set a budget that works for you, and you’re not falling into any of the common pitfalls for overspending.