VA Loan Calculator

Accurately calculate a VA loan payment that accounts for VA disability status, first-time or subsequent-use of VA home loan benefits, property taxes, and homeowners insurance.

VA Funding Fee1.25%

Tax & Insurance

Payment $3,278

| Principal & Interest | $2,236 |

| Property Tax | $833 |

| Home Insurance | $208 |

| PMI not required |

Income Benchmarks

| Housing Ratio | |

|---|---|

| 25% | $158,000 |

| 35% | $113,000 |

| 40% | $99,000 |

| ~ Allowable Debt |

|---|

| $2,380 |

| $770 |

| $260 |

Loan $405,000

| Purchase Price | $500,000 |

| Down Payment • 20% | $100,000 |

| Total Mortgage Payments | $805,111 |

How to Use a VA Loan Calculator

Input the traditional mortgage calculator fields:

- Purchase Price

- Down Payment (not required)

- Interest Rate

- Loan Term

Optionally, add property taxes and homeowners insurance for a more accurate VA loan payment estimation. Finally, toggle on or off your VA disability status and whether or not this is your first time using your VA home loan benefits.

The calculator will provide a full breakdown of a complete VA loan payment estimate, including principal, interest, taxes, insurance, and VA funding fee. Compare VA payment results to conventional, FHA, or USDA loans by toggling from tab to tab.

VA Loan Calculator FAQ

What is the difference between a VA loan calculator and a mortgage calculator?

A VA loan calculator includes VA funding fee costs that impact the total mortgage payment. Traditional mortgage calculators are not capable of handling VA funding fee calculations.

How does a VA loan calculator handle the VA funding fee?

The VA loan calculator has two input toggles that determine the VA funding fee amount to include in payment calculations. The first question pertains to service related VA disability. If checked, the VA funding fee is waived and set to $0. The second toggle addresses first-time vs subsequent-use VA home loan benefits. For VA loans with less than 5% down payments, the VA funding fee is higher if VA mortgage benefits were used previously. The VA loan calculator detects your down payment and computes the VA funding fee accordingly.

Does a VA loan calculator require property taxes and homeowners insurance?

No. There is an option to clear out taxes and insurance. While VA does not mandate it, most VA lenders will require your taxes and insurance be included in your mortgage payment. However, it can be helpful to clear these fields when comparing different VA loan parameters.

Does the VA loan calculator work for refinancing?

VA refinance loans work a bit differently than purchasing a home with a VA loan. For VA refinance calculations, use the VA cash-out refinance calculator and VA IRRRL calculator.

What if I already have a VA loan?

VA home loan benefits can be used more than once. If you had a VA loan and it was paid if full, entitlement can be restored if it isn't already. If you have a VA loan and would like to add a second for the purchase of a new primary residence, use the VA entitlement calculator to determine how your remaining benefits apply to your new purchase.

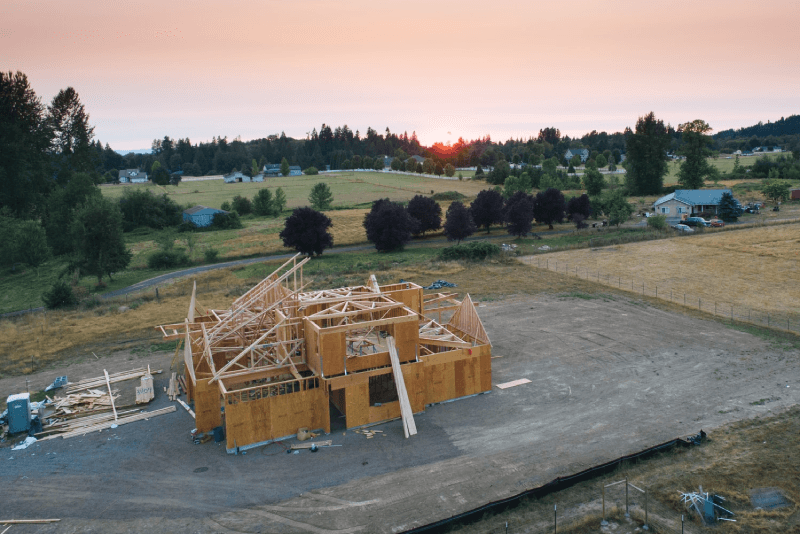

*This calculator does not include VA Construction Loans.