How to Calculate FHA Debt-to-Income Ratio?

Debt-to-Income (DTI) ratios are a primary factor in determining the amount of mortgage for which you can be approved.

Debt-to-Income (DTI) ratios are a primary factor in determining the amount of mortgage for which you can be approved. Understanding your DTI makes you a more prepared homebuyer.

What does DTI mean?

When you apply for a mortgage or begin your research into buying a home, you’ll come across the acronym DTI. DTI is one of those terms that people in the mortgage industry use casually and frequently with the assumption everyone knows what it means. However, if you’ve never purchased a home or applied for a mortgage, you likely have no idea what DTI is.

D is for Debt

The debt you currently have and make payments on directly impacts how much income you have remaining to make your mortgage payment. In addition to making your debt payments on time, lenders are conscious of the amount of debt you have. While the total amount of credit card debt, auto loans, and other money you’ve borrowed is reflected in your credit score, your DTI only considers the amount of your monthly payments.

The D in debt is the total of your monthly debt payments, including the housing payment for which you are applying.

What debts are included in DTI?

Generally, any money you’ve borrowed that needs to be repaid, whether it is being repaid or is in deferment. The most common items included in your DTI include:

- Credit Cards

The minimum payment required on your credit cards, including store cards and other revolving accounts. - Auto Loans

Your car payments, including lease payments. - Boats, Motorcycles, and other installment loans

Money you’ve borrowed to make purchases that you repay over time is included in your DTI. - Student Loans

Even if your payments are deferred, FHA requires the payments be included in your DTI calculation. - Federal Debt

If you are making payments to a federal agency, the payments must be documented and included as debt. - Alimony, Child Support, and Maintenance

Child support and maintenance are included in the monthly debt portion of your DTI. If Alimony can be subtracted from income in lieu of being included as a payment. - Loans in Deferment or Forbearance

The documented payment of loans in a non-payment status must be included. - Student Loans

Whether or not your student loans are being repaid or are deferred, the monthly payment will count in your DTI.

While this list is not exhaustive, most FHA homebuyers will have many of these items included in their DTI. If you have obligations not listed that you feel might be considered in your DTI, an FHA approved lender can assess your situation and provide clarification.

In addition to debts listed above, your new house payment is included in the DTI calculation. This includes your principal and interest, FHA MIP, property taxes, homeowners insurance, and HOA dues. FHA payments include all of these items except HOA dues.

What’s not included in FHA DTI?

The FHA handbook lists the following items it does not consider debt for DTI purposes:

- Medical collection

- Federal, state, and local taxes (if not delinquent and no payments required)

- Automatic savings deductions

- Retirement contributions

- Loans secured by depository accounts

- Utilities

- Child care

- Union dues

- Open accounts with $0 balances

- Insurance, other than property insurance

I is for Income

Monthly debt divided by monthly gross income results in your debt-to-income ratio. Your gross income is before taxes and deductions for items like health insurance and 401(k) contributions.

Gross income is typically your annual salary plus bonuses. If you are paid hourly, it’s your hourly rate multiplied by the number of hours you work weekly times 52 weeks and divided by 12 months. For self-employed borrowers, gross income can become complicated. Your lender will analyze your tax returns and credit report to determine your DTI.

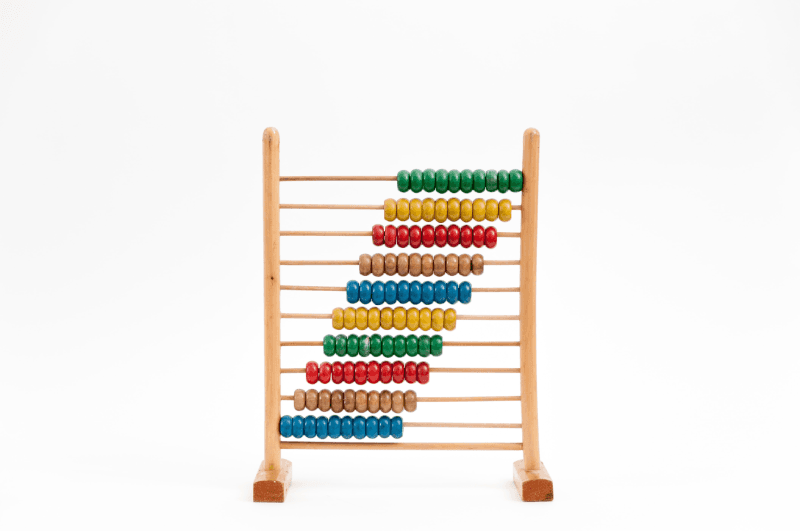

Once your debt payments, new mortgage payment, and monthly gross income is calculated, you can calculate your DTI by dividing the sum of your debt payments and new housing payment by your gross monthly income.

Summary

Understanding your debt-to-income ratio is one step in becoming an educated homebuyer. Having a handle on your monthly payments and calculating your FHA loan payment will allow you to determine how much home you can afford with an FHA loan.

Debt-to-Income Calculator

Calculate your DTI ratio to assess loan eligibility and financial health.

Disclaimer

This calculator provides estimates only and may not be completely accurate. Results are for informational purposes and should not be considered financial advice. Your actual debt-to-income ratio may vary based on individual circumstances, lender requirements, and other factors not included in this calculation.

Always consult with qualified financial professionals or lenders for personalized advice regarding your specific financial situation and loan eligibility. Different lenders may have varying DTI requirements and calculation methods.