Rent to Own: Everything You Need to Know in 2025

Rent-to-own lets you work toward homeownership while renting—but is it a good deal? Learn how it works, the pros and cons, and whether it’s right for you in 2025.

What Is Rent to Own?

Rent-to-own is a hybrid between renting and buying, giving you the option (or obligation) to purchase a home after a lease period. Instead of renting with no long-term benefits, this agreement lets you build toward ownership while living in the home.

Here’s how it works:

- You sign a lease (typically 1-3 years).

- You pay an upfront option fee (usually 1-5% of the home’s value) to secure your right to buy.

- A portion of rent may go toward the purchase price.

- At the end of the lease, you either buy the home or walk away.

If you don’t buy, you lose the option fee and any rent credits, making it essential to have a plan before committing.

How Does Rent to Own Work?

A rent-to-own agreement has two parts:

- The Lease Agreement: Covers rent terms, lease length, and possible rent credits.

- The Option to Buy Agreement: Locks in the purchase price and states whether buying is optional or required.

During the lease, tenants may be responsible for maintenance and repairs, unlike traditional rentals. At the end, you must either secure financing or forfeit any money invested in the agreement.

Pros and Cons of Rent to Own

Who Should Consider Rent to Own?

This option is best for renters who want to buy but aren’t mortgage-ready. It’s a good fit if you:

- Need time to improve credit or save for a down payment.

- Want to lock in today’s home prices.

- Are confident you’ll qualify for a mortgage by the lease’s end.

If you’re unsure about buying or your finances are unstable, traditional renting may be the safer choice.

How to Protect Yourself in a Rent-to-Own Agreement

- Understand the contract – Ensure buying is optional, not required.

- Negotiate fair terms – Secure a reasonable home price and rent credits.

- Plan for financing – Talk to lenders early to avoid mortgage issues later.

- Get legal advice – Rent-to-own contracts can be complex—have a lawyer review the terms.

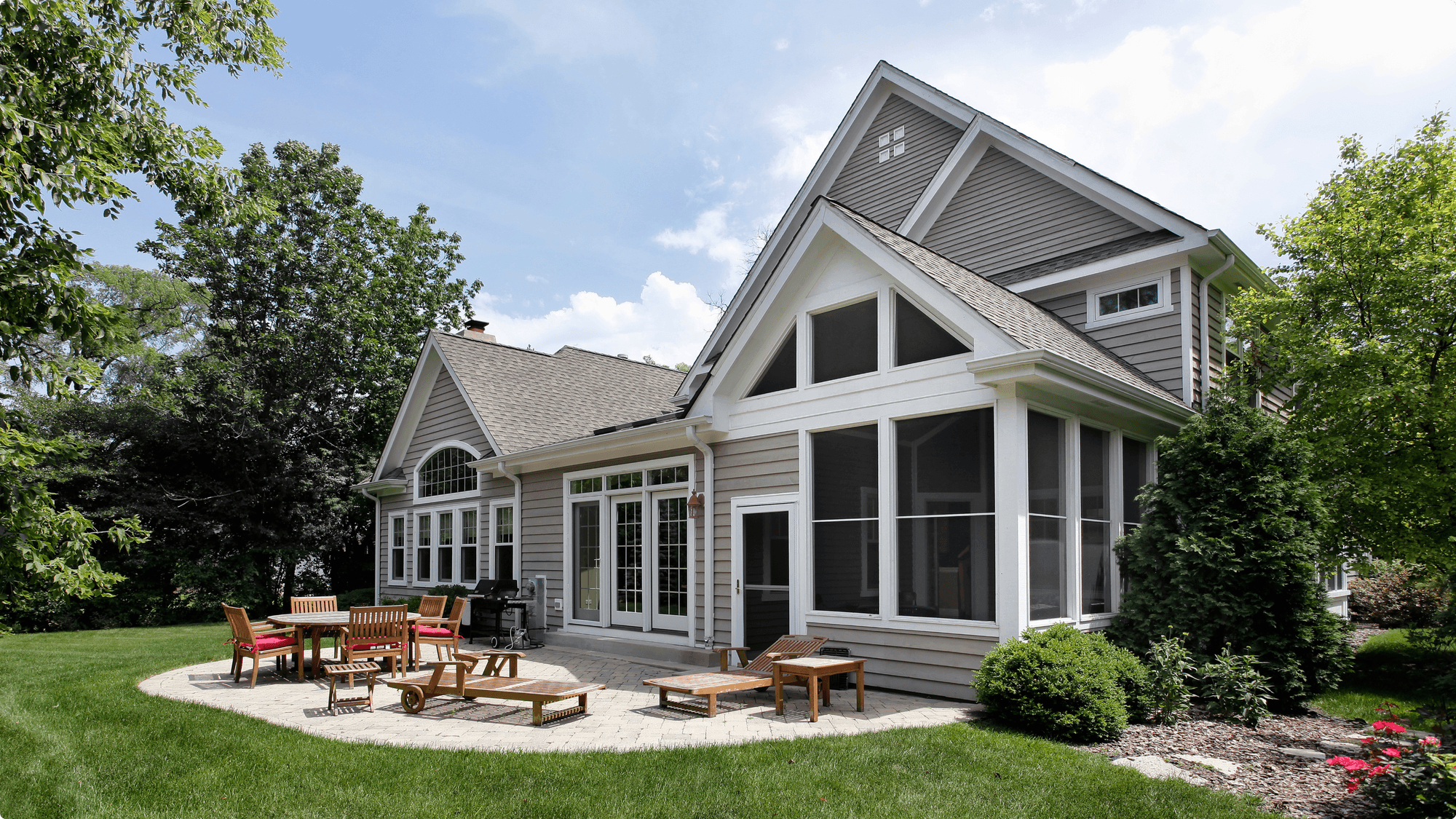

Is Rent to Own a Smart Choice in 2025?

It can be, but only if you’re financially prepared. If you’re confident in your ability to buy and have a solid contract, rent-to-own can be a great stepping stone to homeownership. But if the terms are unfair or your finances are uncertain, it’s a costly risk.

Frequently Asked Questions

1. Is rent-to-own worth it?

It depends. If you’re serious about buying, it can help. But if you back out, you lose money.

2. What happens if I can’t get a mortgage at the end of the lease?

You forfeit your option fee, rent credits, and any chance to buy the home.

3. Can I negotiate a rent-to-own contract?

Yes! Purchase price, rent credits, and responsibilities can all be negotiated.

4. What’s the biggest risk of rent-to-own?

Losing money if you don’t buy the home—especially if the contract has unfavorable terms.